Refund under GST Law

Refund under GST is nowadays an open issue which is a problem for almost all class of taxpayers, majorly exporters which is directly impacting their working capital.

The cases of refund under GST are as below

- Exports with Payment

- Export under LUT/Bond

- Inverted Rate of Duty, Supply to SEZ, Tax Paid by Mistake, Excess Tax in Cash Ledger, etc

Exports with Payment

Prerequisites :

- Registration on Icegate is necessary.

- Timely filing of GSTR 1 and GSTR 3B

- Export Invoice should contain all the relevant details as required under the GST Law

Exports under LUT/Bond

Prerequisites :

- LUT or Bond to be furnished under RFD-11 before undertaking the export transaction. (For Bonds – Bond on Stamp Paper, Bank Guarantee and Authority Letter is also required to be submitted)

- Timely filing of GSTR 1 and GSTR 3B

- Export Invoice should contain all the relevant details as required under the GST Law

Other Cases

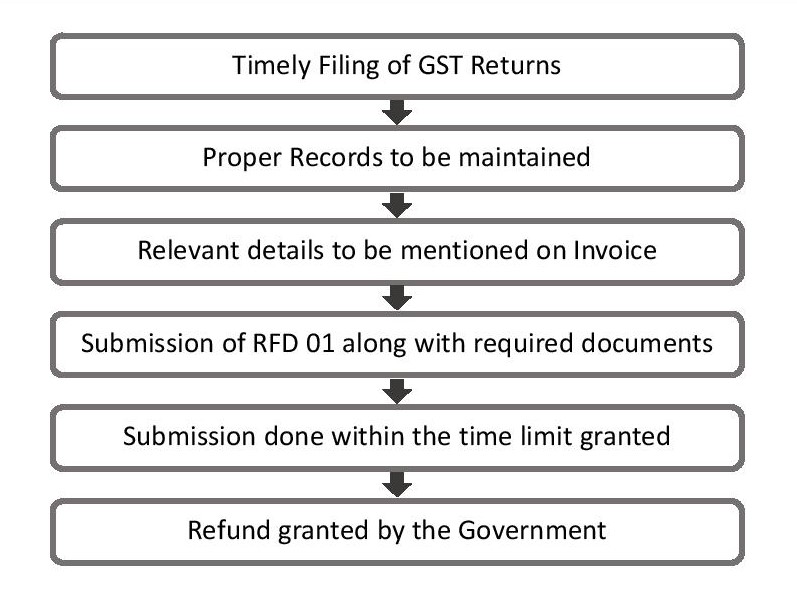

Prerequisites (Inverted Duty, Supply to SEZ, Tax Paid by Mistake or excess tax lying in cash ledger):

- Timely Filing of GSTR 3B

- Timely filing of RFD-01 along with the required documents

- Refund of ITC on Capital Goods cannot be claimed under this option

Other General Points

- Refund to be claimed within 2 yrs of the Relevant Date.(Refer Table below)

- No refund to be granted in case the amount of refund is < Rs 100.

- In case of refund amount > Rs 2 lacs, a certificate by a CA or Cost Accountant needs to be annexed.

- In case of Export with payment of taxes, omission of the details of shipping bill or mismatch of data between the GSTR 1 and the shipping bill would lead to rejection of the claim of refund.

- Remittance in case of Export of Service should only be in Foreign Currency whereas in case of Export of Goods remittance can be in Indian or Foreign Currency.