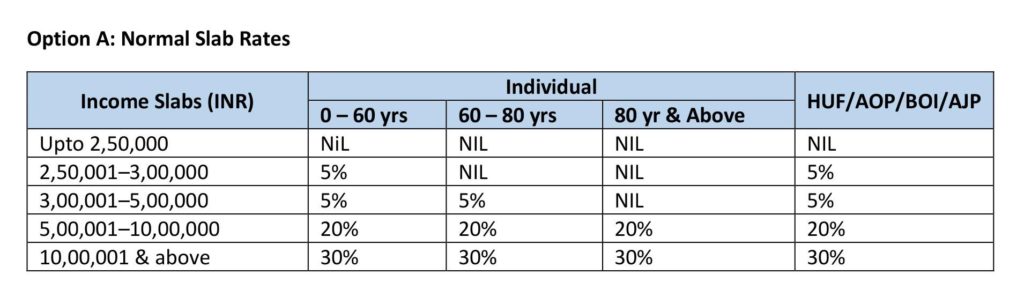

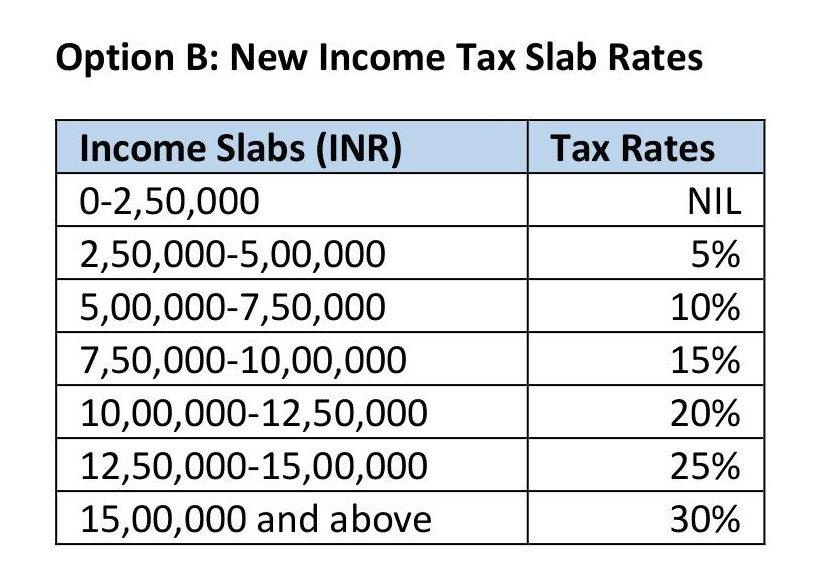

The Finance Bill proposes to provide an option to an Individual / HUF either to pay tax as per existing tax rates or at concessional tax rates subject to the prescribed conditions. AOP / BOI / Artificial Juridical Person will continue to pay tax as per the existing tax rates.

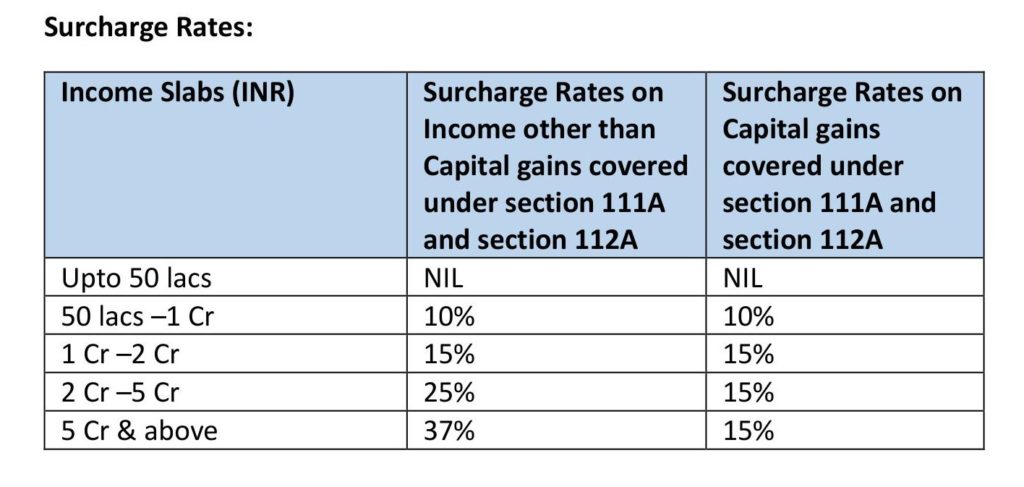

The following rates shall be increased by Surcharge and Education Cess as applicable in the table given below:

Health and Education Cess shall continue to be levied @ 4% on the tax computed inclusive of surcharge (wherever applicable) in all cases.

The above rates shall be increased by Surcharge and Education Cess as applicable in the table above.

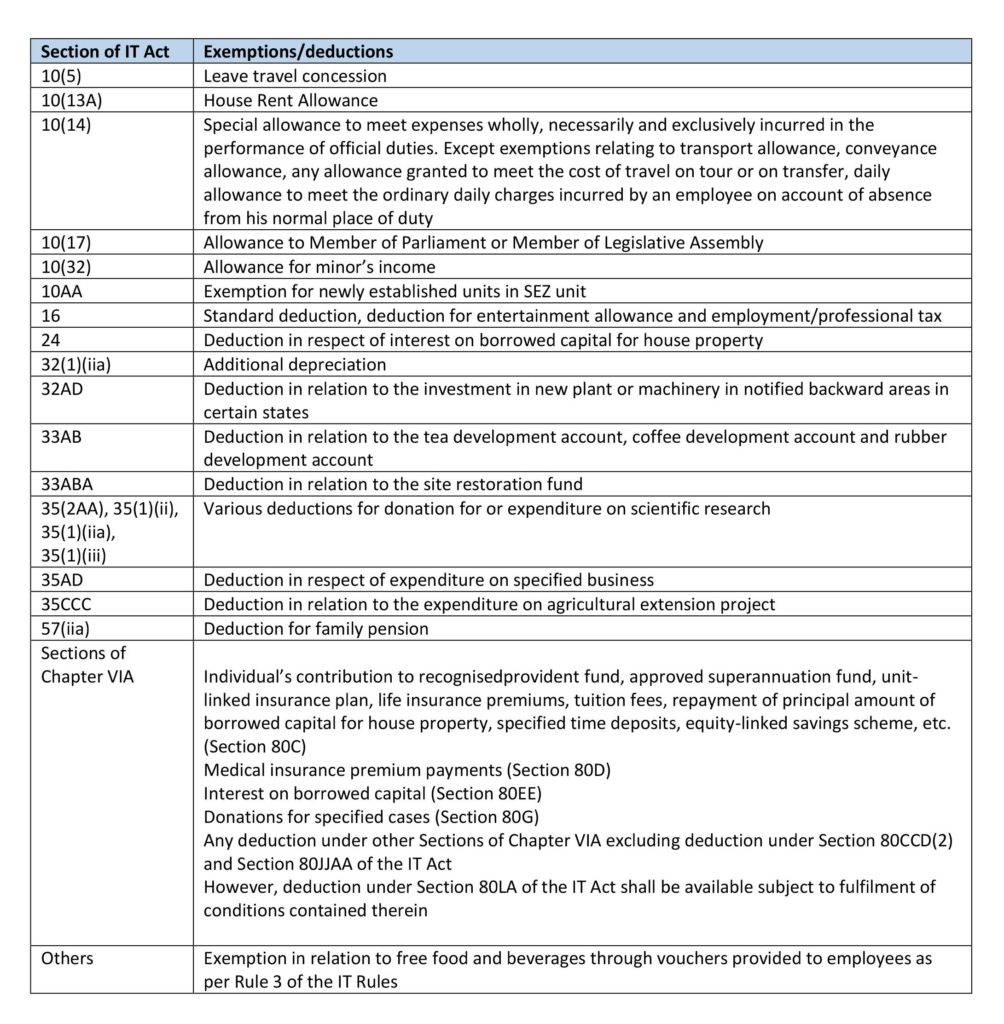

In order to avail the above concessional rates (i.e Option B), the following deductions and exemptions would not be available to an assessee.

- It is further proposed that provisions relating to AMT under section 115JC and 115JD of the IT Act shall NOT BE APPLICABLE to an individual / HUF opting for concessional tax rate under section 115BAC of the IT Act. Consequentially, carry forward and set off of AMT credit, if any, shall not be allowed.

- In case of an individual / HUF NOT HAVING INCOME FROM BUSINESS, the option can be exercised every fiscal year, in the form and manner as may be prescribed, along with the tax return.

- However, in case of an individual and HUF HAVING INCOME FROM BUSINESS, the option can be exercised in the form and manner as may be prescribed, on or before the due date for furnishing of tax return and the option once exercised, shall apply to subsequent years. The option exercised by such individual / HUF can be withdrawn only once in a fiscal year other than the year in which it was exercised. Once the said option is withdrawn, the individual / HUF cannot re-exercise the option unless the individual / HUF ceases to have any business income.