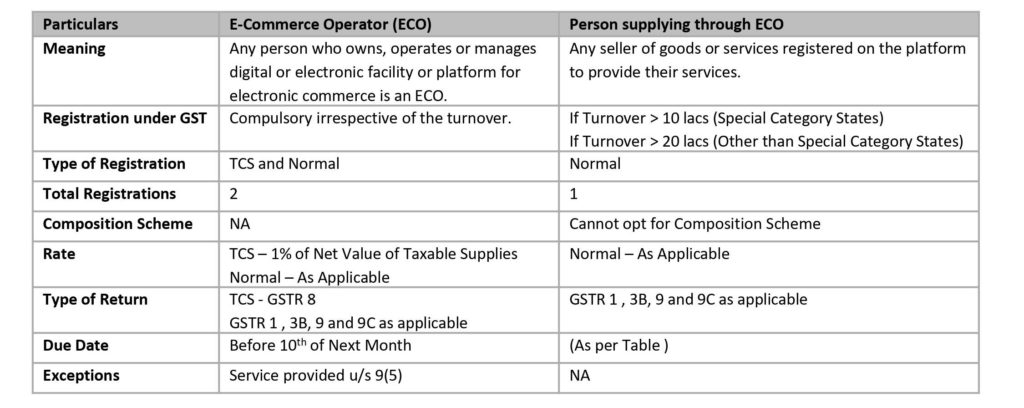

E-Commerce

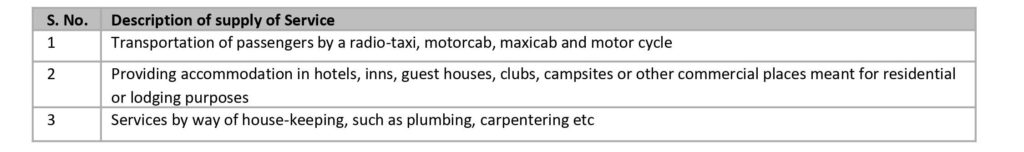

Specified Services u/s 9(5) of CGST Act and u/s 5 (5) of IGST Act

The Government has notified following categories of services, the tax on which shall be paid by the ECO –

However, the persons making supply of services, other than supplies specified under subsection (5) of section 9 is allowed to take benefit of threshold limit.

Registration Limit

Electronic Commerce Operator (ECO)