The reduction in corporate tax rates for domestic companies is a bold and radical measure implemented by the Government to tackle the slow-down in the economy. All domestic companies across all sectors will stand to benefit from the reduction if they opt to sacrifice the tax incentives.

There has been a reduction in the MAT rate from 18.5% to 15% for companies following the existing scheme.In case of companies not availing tax exemptions, the applicability of MAT has been done away with.

The non-applicability of MAT in above cases and reduction in MAT rate in other cases ensure that the reduction in corporate tax rates is truly effective.

Few other changes in the Income Tax Provisions:

- The income tax on notional rent from the second self occupied house has been eliminated.

- To discourage cash transactions and push digital payments TDS at the rate of 2 percent is imposed if the total cash withdrawn in a financial year exceeds Rs 1 crore from a bank, post office or cooperative bank from a single account.

- To provide relief to the Salaried Class, Standard Deduction has been hiked to Rs 50,000.

- Withdrawal of enhanced surcharge on capital gains arising from sale of Equity Shares and units of Equity Oriented Funds.

Effects of changes in Tax Rates

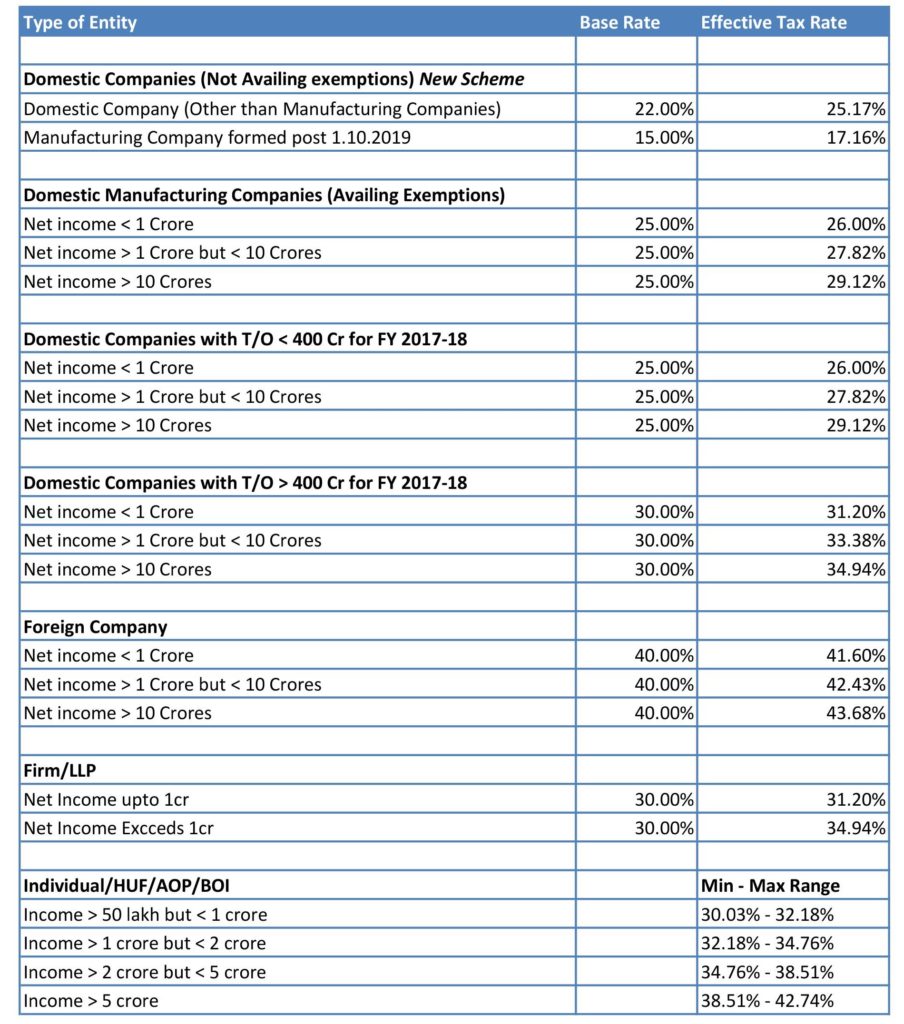

With restructuring tax rates , the government has incentivised corporate structure. On comparing the tax rates of corporate entities vis a vis proprietorship/ LLP / Partnership firms , an apparent benefit of tax rate is visible ranging from 5% to 15%

For Entrepreneurs wanting to get into manufacturing industry ,it is ideal to opt for the new scheme making them eligible to pay tax at just 17.16%. However such new manufacturing facility shall not be a result of restructuring existing business entity.

A shift of business structure from the traditional proprietorship/partnership to a Corporate Structure could be witnessed in the coming times.